The Florida Housing Value Metric: COVID-19 and Housing Concerns

Ken H. Johnson, Ph.D.

Florida Atlantic University

Eli Beracha, Ph.D.

Florida International University

5-18-2020

Emerging questions in Florida revolve around the status of its housing market. Of particular interest at this time, due to COVID-19, is housing prices. Are prices too high, too low, or stable given the fundamentals of the marketplace and the threat of COVID-19 on housing markets? Evidence from this ongoing research suggests that in six of the state’s most populous counties (Miami-Dade, Broward, Palm Beach, Orange, Hillsborough and Duval) as well as Leon county (home to the state’s capital), houses are overpriced relative to their fundamental valuation with noticeable to significant downward pressure on housing prices.

This continually updated research balances the cost of ownership versus renting and reinvesting to produce a housing value metric for each county akin to the P/E ratio for stocks. In this way, housing can be said to be relatively overvalued or undervalued. Using ten years of housing data, county scores are estimated and mathematically mapped to a range between 1 and -1.

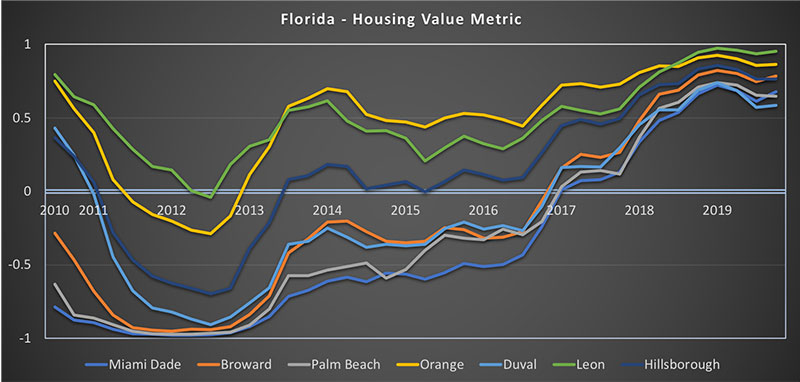

For the housing value metric, scores nearing 1 indicate that housing is significantly overvalued for an area. Scores close to zero suggest very little upward or downward pressure on the demand for property, and prices can be said to be stable or in equilibrium. Scores approximating -1 for an area suggest housing prices are significantly below their fundamental value. Exhibit 1 provides the results for the counties in the study.

Exhibit 1

The housing value metric strongly indicates that homes in Leon, Orange, Broward and Hillsborough are significantly overpriced and the most prone to significant pricing adjustments at this time. These housing markets may also be the most prone to react to any negative impacts on housing brought about by COVID-19.

While the counties of Miami-Dade, Palm Beach and Duval are overpriced, their housing prices, relatively speaking, should experience less of an impact from COVID-19, on average. This holds true for other economic or natural shocks (e.g., hurricanes) these counties might experience as well.

Tracking the housing value metric score for ten years produces a pattern we would expect for Florida. Housing values in each of the counties were falling until roughly 2012; they then began to increase—as fundamental values produced by the metric were critically low—making housing a great investment. As the metric score indicates, properties prices have increased steadily up to the present, and they are now at a level worthy of concern, especially given the presence of COVID-19 and its evolving impact on housing markets.

MEDIA CONTACT: Paul Owers

561-379-8597, powers@fau.edu

- FAU -