Current Housing Market Evaluation for Palm Beach County, Florida

Ken H. Johnson, Ph.D.

Florida Atlantic University

Twitter: @FAUHousingEcon

Eli Beracha, Ph.D.

Florida International University

Pricing Trend Analysis

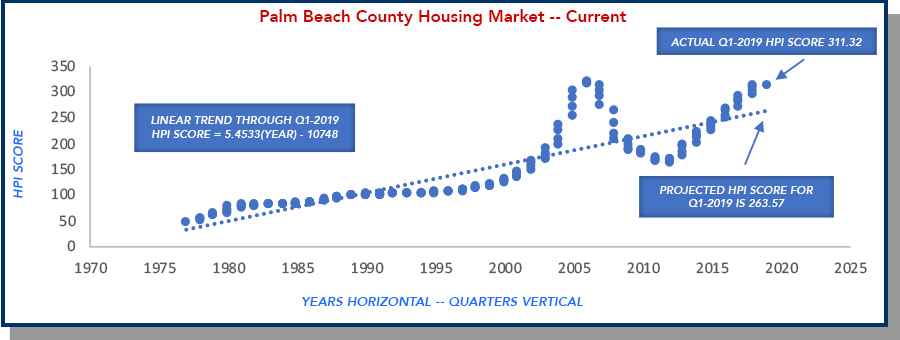

This brief evaluates the current housing market condition for Palm Beach County, Florida. Exhibit 1 provides HPI (Housing Price Index) scores for the county from the last quarter of 1977 through the first quarter of 2019. HPI scores come from a repeat sales index for the area that allows for viewing percentage change in property appreciation rather than actual property price movements. The data is provided by FHFA (Federal Housing Finance Agency) on a quarterly basis.

Exhibit 1

The current HPI score for the county is 311.32, which is slightly below the peak achieved for the county in the second quarter of 2006 of 318.31. Thus, in nominal terms, we are 2.19% ( (311.32-318.31) / (318.31) ) below the all-time housing peak for the county.

Based on the linear trend (HPI=5.4533(Year)-10,748) from over forty years of HPI scores, the HPI for Palm Beach County should currently be 263.57.

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q1-2019 = 5.4533(2019.25) − 10,748

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q1-2019 = 11,011.57 − 10,748

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q1-2019 = 263.57

Thus, housing in Palm Beach County, Florida is presently 18.11% above its long-term fundamental pricing.

Degree Above Long Term Trend = (𝐴𝑐𝑡𝑢𝑎𝑙 𝐻𝑃𝐼q1-2019 − 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q1-2019) / (𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q1-2019)

Degree Above Long Term Trend = (311.32 − 263.57) / (263.57)

Degree Above Long Term Trend = 18.11%

The Palm Beach County housing market also appears to be nearing the peak of its current cycle as witnessed by slowing property appreciation rates. Last quarter’s (Q1-2019) appreciation was .15%. Appreciation for Q4-2018 was 1.35%, while property appreciation for Q3-2018 came in at 2.79%.[i]

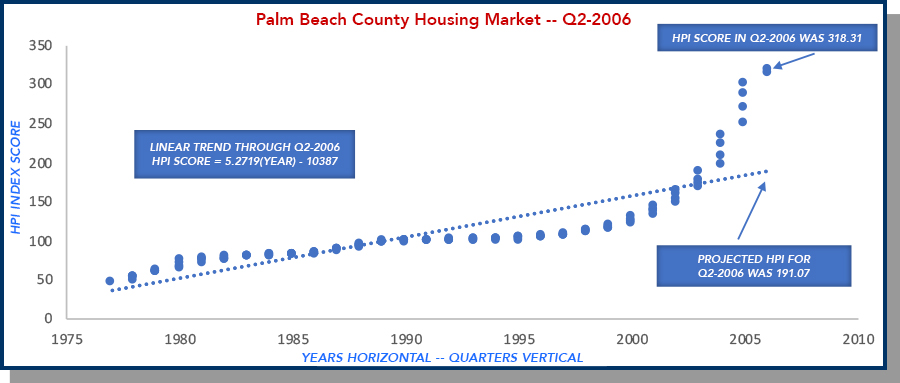

Presently, the county seems to be at an inflection point in its housing market. What is going to happen next is hard to say. Thus, comparing the current level of overpricing to the level of overpricing at the peak of the last cycle seems wise. Exhibit 2 provides a look at HPI scores from Q4-1977 through Q2-2006, where Q2-2006 represents the peak of the last housing cycle in Palm Beach County.

Exhibit 2

The Q2-2006 HPI score for Palm Beach County housing was 318.31. However, the projected HPI for the quarter was only 191.07. Therefore, county housing at the peak of the last cycle was 66.59% above its long-term pricing trend based on data from Q4-1977 through Q2-2006.

Calculating expected HPI for Q2-2006 from the linear trend for the period Q4-1977 through Q2-2006, we see the expected HPI score for Q2-2006 was:

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q2-2006 = 5.2719(2006.50) − 10,387

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q2-2006 = 10,578.07 − 10,387

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q2-2006 = 191.07

Calculating the degree of property overpricing for Q2-2006, we see:

Degree Above Long Term Trend = (𝐴𝑐𝑡𝑢𝑎𝑙 𝐻𝑃𝐼q2-2006 − 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q2-2006) / (𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐻𝑃𝐼q2-2006)

Degree Above Long Term Trend = (318.31 − 191.07) / (191.07)

Degree Above Long Term Trend = 66.59%

Currently, the Palm Beach County housing market is 18.11% above its long-term pricing trend. While this level of overpricing seems significant, it is low relative to the degree of overpricing in 2006, which came in at 66.59%, on average, above fundamental value.

Other Data

|

Type |

Source |

|

Population within a 25-mile radius, is currently 1,485941 with a 14.7% expected increase in the next 10 years. |

|

|

Unemployment in the area is at 3.1%. |

|

|

Median household annual income is $60,059.[ii] |

|

|

Subprime credit rating for the area comes in at 24.71%, which is a 20-year low. |

|

|

The current 30-year fixed mortgage rate is 3.75%, which is down 124 basis points since November of 2018.[iii] |

|

|

Currently, there is moderate downward pressure on the demand for homeownership in the area.[iv] |

https://business.fau.edu/departments/finance/real-estate-initiative/bhj-buy-vs-rent-index |

|

Currently, housing affordability is slightly below its 20-year average for the county. |

https://business.fiu.edu/academic-departments/real-estate/housing-affordability-index.cfm |

Summary

The county appears to be approaching the peak of its current housing market cycle as evidenced by property appreciation continuing to rise but at a decreasing rate. Currently, county housing in the area, based on FHFA data, is 18.11% above its long-term pricing trend, which is significantly less than the degree of overpricing experienced in the county in 2006 when overpricing reach 66.59% above its long-term trend. Other compression on the local housing market comes from the presence of moderate downward pressure on the demand for homeownership (from BH&J Buy vs Rent Index) and the general decrease in housing affordability (from BH&J Housing Affordability Index). On the other hand, population growth, employment, credit ratings, and mortgage rates are all favorable in terms of supporting current housing prices.

Key Takeaways

While it is unclear as to what will happen to property prices in the near term, the preponderance of evidence points to a slowing housing market for the area. However, it seems unlikely that county housing will experience the significant declines witnessed after the peak of the last housing cycle in 2006. Continuing near record low mortgage rates and significant influx of population should serve to stall the impending downturn in local housing.

Audio Podcast Summary with Ken Johnson

Endnotes

[i] Q2-2018 HPI score was 298.37. Q3-2018 score was 306.68. Q4-2018 score was 310.83. And, Q1-2019 score was 311.32.

[ii] FRED database for median household income was recorded as of 1/1/2017.

[iii] Source of data is Freddie Mac via YCharts. Local market rates hover consistently close to Freddie Mac national rates.

[iv] The BH&J Buy vs Rent score of .349 is a composite score for Palm Beach, Broward, and Miami-Dade counties.