New York Metro Housing Market: Not Sharing in Real Estate Pricing Surge

Denise Hunter Gravatt, DBA

Florida Atlantic University

Eli Beracha, Ph.D.

Florida International University

Ken H. Johnson. Ph.D

Florida Atlantic University

9-22-2020

While much of the nation is seeing rising home values, the New York metropolitan area is not participating in this valuation increase. Currently, the New York metro, the country’s largest metropolitan area, has seen its average home price fall over the last quarter at an annualized rate of -1.2%. Going back one year, housing values in the metro are experiencing a sluggish annualized growth rate of 2.5%.

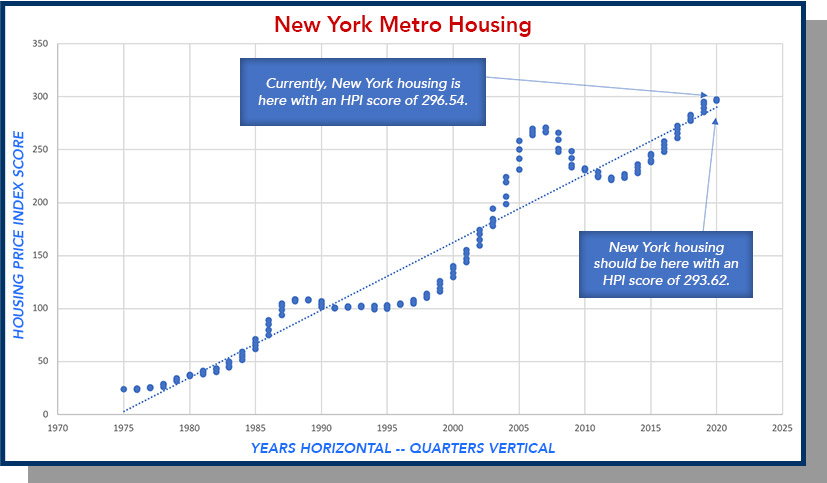

Looking back at over 40 years of repeat sales transactions in the New York metro area (Figure 1) reveals additional information about the current status of housing values in the area.

Figure 1. New York Metro Housing Housing Price Index

Specifically, the average property price in the New York metro is currently 1% above its long-term pricing trend.[i]

A number of factors including mortgage rates being heavily influenced by the Federal Government actions to prop up the U.S. economy due to COVID-19 (namely the Federal Reserve purchases of government debt to keep rates low), a shortage in available housing both for sale and rent, and population movements are influencing homes values around the country and New York is no exception.

The long-term pricing trend for New York is one of the highest in the nation allowing New York to historically work out of any short-term housing valuation problems it has experienced in the past. It is unsettling, however, to see valuation be so tepid in the area in the presence of record low mortgage rates which have traditionally led to rapidly rising home values especially in historically high demand areas.

Key Takeaways

What does all of this mean for home values moving forward in the New York area? There appear to be two possibilities.

- There has been a permanent structural break in the demand for living in the area. It could be that weather, taxes, COVID-19 and civil unrest have finally combined to fundamentally change the desire of people to live and work in the New York metropolitan area. Thus, with the inevitable cessation of FED purchases of government debt and the responding influence on the 10-year Treasury yields, rising mortgage rates could deliver a death knell to area housing values resulting in falling property values in the short term and a long-term flattening in the slope of property value appreciation, making it difficult for New York to easily out grow its real estate issues.[ii]

- Alternatively, a permanent structural break in the demand for living and working in the area has not occurred and, as so many times in the past, New York will bounce bank to remain the cultural and business epicenter of the country. In the short-term property values should be flat to declining; however, long-term the high demand for living in New York will continue and the area will return to its age-old ways of simply outgrowing its real estate problems rather quickly.