Overpricing in South Florida Housing Markets: December 2020

Denise Gravatt, DBA

Florida Atlantic University

Eli Beracha, Ph.D.

Florida International University

Ken H. Johnson, Ph.D.

Florida Atlantic University

12-16-2020

Housing prices continue to increase around the country as the housing market appears to edge closer to what some economists suggest to be the peak of the current housing cycle that started in 2012.

Homes in some regions, like Southeast Florida, persist in being overvalued based on historical pricing. Comprised of the state’s three most populated counties—Palm Beach, Broward and Miami-Dade—Southeast Florida has seen home values climb to an all-time valuation high. In fact, homes in the region are pricing considerably above their long-term pricing trend based on over 40 years of data from the Federal Housing Finance Agency (FHFA). The specific data employed in this brief are Housing Price Index (HPI) scores. These scores are calculated through a repeat sales index methodology of all transactions in an area. This standardized methodology allows for the tracking of market prices and their percentage change through time.[i]

Recognizing that home values follow a mean reverting trend, this brief analyzes quarterly Housing Price Index (HPI) scores from FHFA for each county—Palm Beach, Broward, and Miami-Dade. Quarterly HPI scores are plotted, and a linear trend is regressed through the quarterly HPI scores.

The linear trend line represents average annual appreciation for properties in each respective county. Plotted points above the trend line represent parts of the upper half of a housing cycle, while plotted points below the trend line represent parts of the lower half of a housing cycle. Extreme points, where quarterly scores group together, in either the upper half or lower half, represent the peak or bottom of a given housing cycle, respectively. The trend equation estimate (provided in Figures 1,2 and 3) provides a point estimate of where homes prices should be at any given point in time. In particular, the current implied HPI score for each county can be estimated and compared to its actual HPI score to calculate a degree of over or underpricing of homes for each county.

Figure 1 provides the graph of historic HPI scores for Palm Beach County.

Based on over 40 years of prices for Palm Beach County, current home prices should exhibit an HPI score of 278.10. However, the current actual HPI score is 329.04. The difference represents a present average property overpricing of 18.32% in the county. The average home in Palm Beach County is 18.32% above its long-term pricing trend and down from 18.7% in July of 2020.

Figure 2 below provides the depiction of HPI scores for Broward County.

Based on the HPI estimation equation (upper left corner), current HPI scores for Broward County should be at 282.14. The actual HPI score for the county is 328.45 placing the average home in Broward County at 16.41% above its long-term pricing trend. In July 2020, this figure was 17.40%.

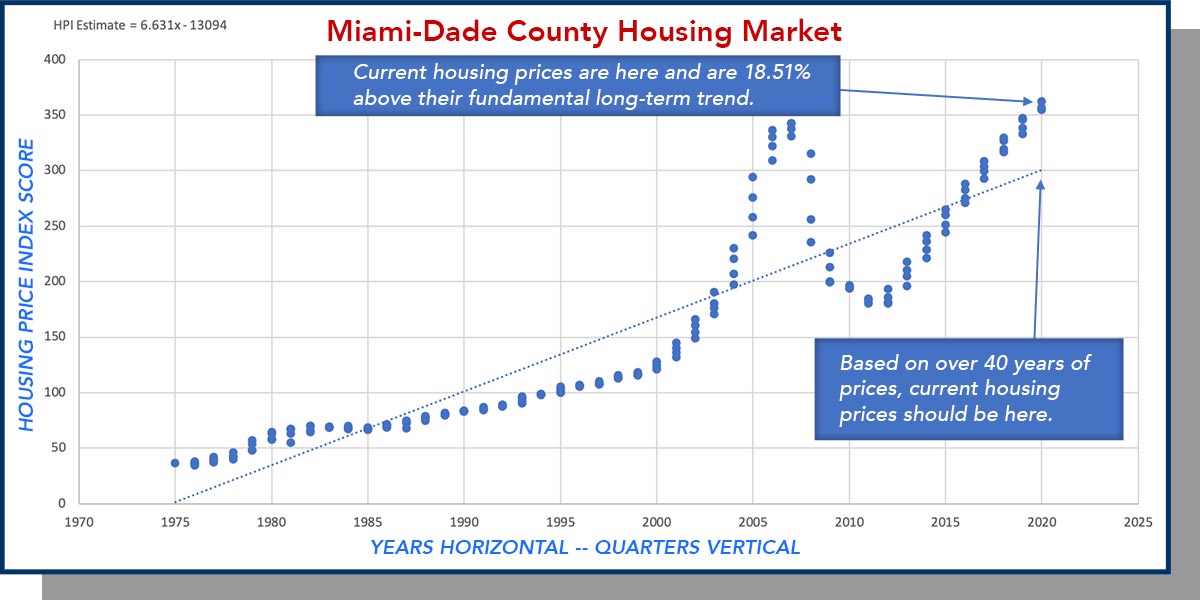

Figure 3 reveals HPI scores for Miami-Dade County from late 1975 through the latest data report.

The current HPI score for Miami-Dade County is 362.15. The current HPI estimation for the county based on past housing performance is 305.59. Calculating the percentage differences reveals that the average home in Miami-Dade is 18.51% above its long-term pricing mean. The estimate for the degree of overpricing for Miami-Dade homes in July 2020 was 19.20%.

The average homes in Palm Beach, Broward and Miami-Dade counties are currently above their long-term pricing trends. However, the degree of overpricing has decreased slightly across all three counties since July of 2020. Table 1 summarizes these results.

Table 1

Degree of Property Overpricing In Southeast Florida by County

| Palm Beach | Broward | Miami-Dade | |

| Current | 18.32% | 16.41% | 18.51% |

| July 2020 | 18.7% | 17.40% | 19.20% |

Finally, in all three counties, property prices appear to be increasing at a decreasing rate, strongly suggesting that the respective housing markets are at or near the peak of their current housing cycles. Evidence of this appears in each county’s graph as quarterly HPI scores group closely together near the peak or bottom of each cycle.

Summary

Given the near historically low mortgage rates coupled with the existing property inventory shortage, the high degree of overpricing is not entirely surprising. Though this overpricing may appear unnervingly reminiscent of the historic housing bust of 2006-2011, the current amount of overpricing and the economic climate are significantly different. The average property across all three counties in 2008 was roughly 65% above its long-term pricing trend. Additionally, the economic climate was significantly different with noticeably higher mortgage rates, far weaker underwriting standards, and an inventory glut.

Home values follow a mean reverting trend, implying that housing prices do not grow to the sky or crash to the bottom. Instead, they constantly hover around a long-term historically upward sloping trend. How housing markets find their way back to their long-term trend varies with economic circumstances as numerous forces such as housing inventory, mortgage rates, alternative investments, rental rates, and property maintenance and taxes, among others, interact to enforce this equilibrium.

Housing markets can wildly and rapidly crash as they did from the peak of the last cycle. Markets can swing form upside to downside and back rather symmetrically, or they can stall and slowly revert to the long-term trend. All that is necessary for the latter case is for current housing prices to increase at a rate lower than that of the long-term trend.[ii][iii] This last case appears most likely for the current set of Southeast Florida housing market comprised of Palm Beach, Broward and Miami-Dade counties. Near record low interest rates and the significant inventory shortage combined with buyers who bargain aggressively should allow for the markets to slowly revert to their long-term trend.

Thus, the responsibility for keeping a reasonable lid on housing prices across the three counties rests squarely on the shoulders of current buyers.

Key Takeaways

It appears most likely that Palm Beach, Broward and Miami-Dade counties are at or near the peak of their current housing cycles. Prospective buyers should be aware of the following:

- Buying in a housing market above its long-term trend—especially one near its peak—requires far more due diligence on the part of potential buyers.

- Establish local values:

- Review third party-information platforms (e.g. Zillow, Redfin, and Realtor.com).

- Regularly tour homes for sale in neighborhoods of interest.

- Check nearby sold properties.

- The higher the degree of overpricing in a housing market, the more aggressive a buyer should be in bargaining.

- The nearer a market is to a peak in the housing cycle, the more aggressive a buyer should be in bargaining.

- Be willing to walk away from a deal that is too high or has bad terms; there will always be another property.

- No buyer wants to be the last one to buy at the peak of a cycle.

Endnotes

[i] HPI scores work very much like stock market indices (e.g. the DOW or S&P 500) allowing for the tracking of price movements of an overall market. Points/scores can be compared to calculate percentage increases or decreases across varying points in time.

[ii] This example argues from the standpoint of the current market.

[iii] In fact, housing markets can reignite and start upward or downward again without

completely reverting to their long-term trend. This example is very, very rare and

requires a fundamental shift in the paradigm around homeownership. For example, a

dramatic drop in population could send housing on a prolonged downward trend until

a new trend regime develops.