Occupation Fraud

Occupational fraud generally refers to fraud committed by an organization's employees. This kind of fraud can be put into three categories: asset misappropriation, corruption, and financial statement fraud. According to the Association of Certified Fraud Examiners’ (ACFE) 2018 Report to the Nations, the U.S. median loss from occupational fraud is around $108,000.[1]

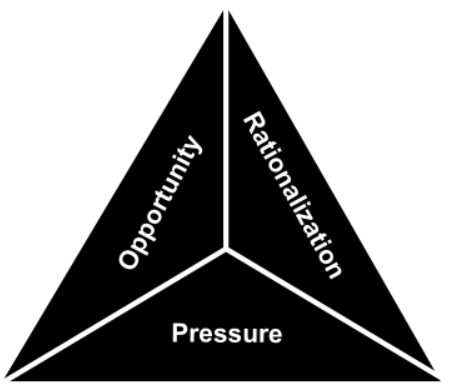

Although there is not a typical profile of a fraudster in this area, evidence shows the presence of pressure, opportunity, and rationalization in each case on average. Next, we describe these factors.

The Fraud Triangle

What causes an employee to commit fraud? Human behavior is complicated. A prominent theory of what causes fraud identifies three factors: pressure, opportunity, and rationalization. The theory is known to as the “fraud triangle” documented in 1950 by UCLA professors from interviewing inmates of the Illinois state prison in Joliet.

Pressure may be a crucial element in many aspects of life. The need to be financially stable

or some non-sharable problem such as high medical bills, gambling debts, or excessive

lifestyles can motivate an employee to commit fraud. Pressure can also come from an

organization itself put on employees by forcing an employee to perform better or cover

up negative results to look good.

Pressure may be a crucial element in many aspects of life. The need to be financially stable

or some non-sharable problem such as high medical bills, gambling debts, or excessive

lifestyles can motivate an employee to commit fraud. Pressure can also come from an

organization itself put on employees by forcing an employee to perform better or cover

up negative results to look good.

Opportunity is another factor explaining fraud and usually more obvious than pressure. For any organization to function, a certain level of trust must be placed in employees. This factor arises when an entrusted employee violates that trust by taking advantage of their position to commit fraud.

Rationalization, the third factor, is typically a person’s excuse for committing the fraud. In many cases, perpetrators tell themselves that they are only temporarily borrowing from the organization. In other cases, perpetrators might rationalize their actions with thoughts like, “they won’t miss the money,” or “the organization deserves what it is getting.”

Occupational Fraud Categories

Occupational fraud, as stated, can be put into three categories: asset misappropriation, corruption, and financial statement fraud. We describe these areas next.

Asset Misappropriation is the most common form of occupational fraud but the least costly on average. It occurs when an employee improperly uses an employer’s asset for personal use. It is not as simple as money being stolen by simple theft as it can also occur when the employee borrows or misuses money for personal reasons. Common cash theft is the simplest form of asset misappropriation. In addition to this simple form, more sophisticated ways of asset misappropriation may occur in three areas of an organization: its revenue cycle, expenditure cycle, and production cycle.

- Revenue cycle fraud (cash receipts): examples include sales skimming, theft of cash or checks, and improper credit approval.

- Expenditure cycle fraud (cash disbursements): examples include improper purchases, payroll fraud, and improper payments.

- Production cycle fraud: examples includes payroll and inventory fraud (claiming more hours than actually worked; theft of raw materials and finished goods).

There are many other schemes of asset misappropriation as any organization’s assets can disappear without proper controls. Examples include theft of company checks, improper use of company assets for collateral, improper guarantees to customers, and so on. With the increasing use of technology, new schemes of asset misappropriation continue to emerge. Weak accounting controls over digital information can make identifying a perpetrator difficult or nearly impossible.

Corruption is the second most common type of occupational fraud. The main form of corruption consists of an individual exercising their undue influence upon others. Examples of this form are conflicts of interest, bribery, improper gratuities, and economic extortion. Corruption is mostly seen in bid rigging and kickback cases.

Financial Statement Fraud occurs when an individual manipulates an organization’s financial statements. This kind of fraud not only damages the company, but it also damages lenders, shareholders, and others who rely on financial statements to make decisions. Financial statement fraud is usually perpetrated by senior managers. Although it is the least common form of occupational fraud, on average financial statement fraud is the most costly. Reasons for manipulating financial statements range from poor company performance to greed, and it appears where an opportunity is present. The most common form of financial statement fraud is manipulating profits.

To reduce occupational fraud, an organization should be aware of its risks and internal weaknesses; implement effective controls; and have regular monitoring, internal and external audits, reconciliations, and physical inspections. ACFE’s 2018 Report to the Nations shows a negative correlation between fraud controls and the median percentage loss. More controls tend to be associated with a lower fraud loss rate. In addition, an organization can provide fraud detection systems such as tip hotlines and open-door policies where anonymity and confidentiality are guaranteed. In general, controls that minimize opportunities and motivation along with strong fraud detection systems will likely translate into a reduction of losses due to fraud.

[1] Association of Certified Fraud Examiners. (2018). Report to the Nations: 2018 Global Study on Occupational Fraud and Abuse (pp. 7, 71). Retrieved on October 31, 2018 from https://s3-us-west-2.amazonaws.com/acfepublic/2018-report-to-the-nations.pdf