- Master of Accounting in Forensic Accounting

- Program Information

- Information Sessions and Events

- Admission

- Program Calendar

- FAU College of Business Faculty

- Student Profile

- Tuition & Payment Options

- Dual Degree

- Executive Education Alumni Engagement

- Digital Accounting Forensics and Data Analytics (EMAC Concentration)

- Forensic Accounting (EMAC Concentration)

- Professional Accounting (EMAC Concentration)

- Tax (EMAC Concentration)

- Certificates & CPE-CPA Credits

- Executive Master's in Taxation (EMTAX)

- Program Information

- Information Sessions and Events

- Admission

- Curriculum

- Program Calendar

- FAU College of Business Faculty

- Student Profile

- Tuition & Payment Options

- Dual Degree

Executive Master of Taxation (EMTAX) Program Information

Executive Master of Taxation (EMTAX)

The Executive Master of Taxation (EMTAX) degree program was designed to meet the demand for tax specialists in public accounting, private sector, and the government. Its objectives include rigorous development of:

- Technical competence

- An appreciation of tax policy

- A conceptual understanding of taxation

- An awareness of the responsibilities of a tax professional

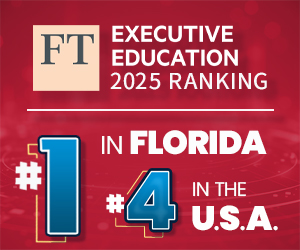

The courses of the EMTAX program may be used to satisfy the education requirements of the CPA and other professional licenses. The degree program is offered by the Office of Executive Education, a department in FAU’s AACSB-accredited and nationally recognized College of Business.

The EMTAX program provides an environment where a concentrated effort between professor and student results in the mastery of all the components of a graduate-level tax curriculum. The goal is to ensure students graduate with technical, analytical, communication, interpersonal, and lifelong learning skills.

The program allows participants to continue their professional responsibilities while earning a graduate degree. The curriculum allows non-accounting undergraduate degree students to complete the program by taking two additional courses built into the schedule. Prerequisites are not required outside of the program. Each cohort begins and progresses through the program sharing the same sequence of classes and educational experiences.

Upon completion of the EMTAX program, students will have earned the Master of Taxation degree.

If you're interested in our Executive Master of Accounting program, click here to learn more.