- 2024 Hispanic Index of Consumer Sentiment

- 2023 Hispanic Index of Consumer Sentiment

- 2022 Hispanic Index of Consumer Sentiment

- 2021 Hispanic Index of Consumer Sentiment

- 2020 Hispanic Index of Consumer Sentiment

- 2019 Hispanic Index of Consumer Sentiment

- 2018 Hispanic Index of Consumer Sentiment

- 2017 Hispanic Index of Consumer Sentiment

- 2016 Hispanic Index of Consumer Sentiment

- 2015 Hispanic Index of Consumer Sentiment

- 2014 Hispanic Index of Consumer Sentiment

2018 Hispanic Index of Consumer Sentiment

Fourth Quarter 2018

TOPLINESRESULTSPRESS RELEASE

HISPANICS CONSUMER CONFIDENCE IS STRONG GOING INTO 2019

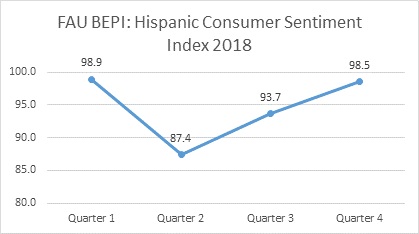

Hispanics in the United States feel more optimistic about their financial situation as well as the U.S. economy as they go into 2019. The fourth quarter Hispanic Consumer Sentiment Index (HCSI) is at 98.5, which is around 5 points higher compared to the third quarter score of 93.7 and it is almost as high as the first quarter’s score of 98.9. In addition, the Sentiment Index averaged 94.6 in 2018, which is slightly higher than its average of 93.3 in 2017. Finally, HCSI in the 4th quarter has caught up with the nation’s Consumer Sentiment Index (4th quarter average of 98.2).as published by the University of Michigan.

Overall, the majority of Hispanics are optimistic about their financial situation going into 2019. Below are the detailed results of the five questions used to generate the Hispanic Consumer Sentiment Index:

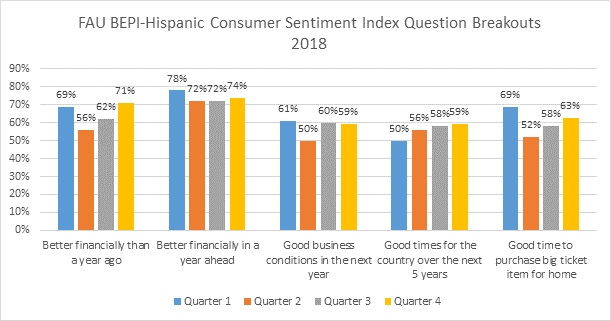

- In the fourth quarter, 71% of Hispanics said they are better off financially today than a year ago compared to 62% in the third quarter, which is an increase of 9 points.

- In the fourth quarter, 74% of Hispanics said they expect to be better off financially in the next year compared to 72% in the third quarter, which is an increase of 2 points.

- Regarding the short run economic outlook of the country, 59% of Hispanics said that they expect the country to experience good business conditions in the upcoming year; down 1 point compared to the third quarter (quarter 3 was 60%).

- In terms of long run economic outlook of the country, 59% of Hispanics said that they expect the economic outlook of the country to be good in the next five years, up 1 point compared to the third quarter (q3=58%).

- Overall, in the third quarter 63% of Hispanics think it is good time to buy big ticket items compared to 58% percent in the third quarter, which is an increase of 5 points.

Other key findings:

- Level of debt: Level of debt in the fourth quarter has become a major problem for 28% of Hispanics up from 22% in Q3, and more in line with the 31% in Q2.

- Cost of living: In the fourth quarter, 65% of Hispanics said the cost of living has gone up compared to 70% in the third quarter.

- Gas prices: In the fourth quarter, 52% of Hispanics expect gas prices to increase compared to 54% in the last quarter.

- Interest rates: In the fourth quarter, 64% of Hispanics expect interest rates to go up compared to 54% in the third quarter.

- Buying a House: In the fourth quarter 52% of Hispanics think it is a good time to buy a house, which is similar to the values of the third and second quarters (q3=51% and q2=51%).

- Buying a Car: In the fourth quarter, 63% of Hispanics think it is a good time to buy a car compared to 53% in the third quarter and 49% in the second quarter.

- It appears that Hispanics’ optimism of their personal finances and optimism on the economic outlook of the country has also affected President Trump’s approval rating which saw an increase of 3 points to a 40% approval compared to 37% in the previous quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Survey Sampling International SSI. There were 700 respondents sampled between October 1 and December 31, 2018 and a credibility interval, a measure of accuracy, of 3.7 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, and age according to latest American Community Survey data.

Third Quarter 2018

The third quarter Hispanic Consumer Sentiment Index (HCSI) finds that the Hispanic population’s consumer confidence in the U.S. has increased compared to the second quarter. Looking at some demographic breakdowns, Republican Hispanics are more optimistic than Democrats and younger Hispanics (18-34) are more optimistic compared to older Hispanics.

Specifically, the Hispanic Consumer Sentiment Index (HCSI) increased from 86.4 in the second quarter to 93.77 in the third quarter. The HCSI continues to trail the general population score of 98.1 for the third quarter as published by the University of Michigan in September 28th, 2018.

Overall, there is an in optimism in four out of the five questions used to generate the Hispanic Consumer Sentiment Index. Below are the detailed results:

- In the third quarter, 62% of Hispanics said they are better off financially than a year ago compared to 56% in the second quarter, which is an increase of 6 points.

- In the third quarter, 72% of Hispanics indicated they will be better off over the next year which has no change compared to the second quarter (in second quarter it was 72% as well)

- Regarding the short run economic outlook of the country, 60% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year; up 10 points compared to the second quarter (quarter 2 was 50%).

-

In terms of long run economic outlook of the country, Hispanics are more optimistic in the third quarter compared to the second quarter (58% vs. 56%).

- Overall, in the third quarter 58% percent of Hispanics think it is good time to buy big ticket items compared to 52% percent in the second quarter.

- Level of debt: Level of debt has become a major problem for 22% of Hispanics down from 31% in Q2, and more in line with the 22% in Q1.

- Cost of living: 70% of Hispanics said the cost of living has gone up, this a decrease of 10 points compared to the second quarter (80%).

- Gas prices: 54%, expect gas prices to increase compared to 68% in the last quarter, a decrease of 14 points

- Interest rates: 54% of Hispanics expect interest rates to go up compared to 62% in the second quarter.

- Buying a House: 51% of Hispanics think it is a good time to buy a house, which has remain the same compared to last quarter and decreased by 8 points when compared to 59% in the first quarter

- Buying a Car: 53% of Hispanics think it is a good time to buy a car compared to 49% in the second quarter and 62% in the first quarter.

- It appears the positive economic conditions of this quarter has also affected President Trump’s approval rating which saw an increase of 4 points to a 37% approval compared to 33% in the previous quarter. It has gone back to the same level of the first quarter.

Second Quarter 2018

| TOPLINES | RESULTS | PRESS RELEASE |

The second quarter Hispanic Consumer Sentiment Index (HCSI) finds that the Hispanic population’s consumer confidence in the U.S. has deteriorated compared to the first quarter.

Specifically, the Hispanic Consumer Sentiment Index (HCSI) dropped from 98.9 in the first quarter to an 86.4 in the second quarter. The HCSI continues to trail the general population score of 98.2 as published by the University of Michigan in June 2018.

Overall, there is a decrease in optimism in four out of the five questions used to generate the Hispanic Consumer Sentiment Index. Below are the detailed results:

- In the second quarter, only 56% of Hispanics said they are better off financially

than a year ago compared to 69% in the first quarter.

- Women are more optimistic of their current financial situation compared to men (66% vs. 46%).

- Hispanics between 18-34 year old (63%) and those above 55 years old (69%) are more optimistic of their current financial situation than those between 35-54 year old (43%).

- In the second quarter, 72% of Hispanics indicated they will be better off over the

next year compared to 78% in the first quarter.

- Women are more optimistic of their future financial situation compared to men (71% vs. 66%).

- Hispanics between 18-34 year old (81%) are most optimistic of their future financial situation compared to the other age groups (35-54 year old (68%) and above 55 years old (58%).

- Regarding the short run economic outlook of the country, 50% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year; still down 11 points compared to the first quarter (quarter 1 was 61%).

- In terms of long run economic outlook of the country, Hispanics are more optimistic in the second quarter compared to the first quarter (56% vs. 50%).

- Overall, in the second quarter 52% percent of Hispanics think it is good time to buy big ticket items compared to 69% percent in the first quarter.

Other key findings:

- Level of debt: Level of debt has become a major problem for 31% of Hispanics up from 22% in Q1, and more in line with the 30% in Q4.

- Cost of living: 80% of Hispanics perceived that the cost of living has gone up, this an increase of 21 points compared to the first quarter (59%).

- Gas prices: A growing majority of Hispanics, 68%, expect gas prices to increase compared to 53% in the last quarter.

- Interest rates: 62% of Hispanics expect interest rates to go up compared to 51% in the first quarter.

- Buying a House: Due to the perceptions of increase in the cost of living, level of debt, interest rates, and less optimism of their own financial situation, only 51% of Hispanics think it is a good time to buy a house compared to 59% in the first quarter.

- Buying a Car: Due to the perceptions of increase in the cost of living, level of debt, interest rates, and less optimism of their own financial situation, only 49% of Hispanics think it is a good time to buy a car compared to 62% in the first quarter.

- It appears the negative economic conditions have also effected President Trump’s approval rating which saw a drop of 4 points to a 33% approval compared to 37% in the previous quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection (50%) and online data collection (50%) using Survey Sampling International SSI. There were 850 respondents sampled between April 1 and June 30, 2018 and a credibility interval, a measure of accuracy, of +/- 4.0 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, and age according to latest American Community Survey data.

First Quarter 2018

| Toplines | Results | Press Release |

The first FAU BEPI quarterly Hispanic Consumer Sentiment Index (HCSI) for 2018 finds the Hispanic population’s economic conditions in the US has generally improved in the last 3 months. The HCSI score increased from 93.5 in quarter 4 of 2017 to 98.9 in quarter 1 of 2018 giving it the highest score since HCSI went to a quarterly count in 2016. The HCSI continues to trail the general population score of 101.4 as published by the University of Michigan in March 2018.

Hispanics are more optimistic about their personal finances in the first quarter of 2018 compared to the last quarter of 2017. Overall, 69% of Hispanics indicate that they are financially better today than a year ago, up 4 points from last quarter (q4=65%). In addition, 78% of Hispanics are optimistic about their financial future, up 7 points compared to last quarter of 2017 (q4=71%). Finally, 69% of Hispanics think it is a good time to purchase big ticket items for their homes, up 17 points compared to 52% in the last quarter. Perhaps this is due to the fact that interest rates are going up and it is better to lock lower interest rates today and higher interest rates in the future.

Other key findings include:

- Level of debt has dropped among Hispanics with only 22% reporting debt as a major problem, down from 30% in Q4. However 50% report debt as a minor problem and 28% said it was not a problem at all.

- 59% said it was a good time to buy a home and 62% said it was a good time to buy a car. Supporting for such large purchase might be attributed to the 51% of Hispanics who expect interest rates to go up compared with 17% who expect it to go down.

- The cost of living continues to increase for the majority of Hispanics with 59% saying it has gone up while 23% said it has gone down.

- A majority of Hispanics, 53%, expect gas prices to increase while 17% thought gas prices would go down.

- President Trump has a 37% approval and 63% disapproval among Hispanics.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection (24%) and online data collection (76%) using Survey Sampling International SSI. There were 755 respondents sampled between January and March 31, 2018 and a credibility interval, a measure of accuracy, of 4.3 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, income and age according to latest American Community Survey data.