- 2024 Hispanic Index of Consumer Sentiment

- 2023 Hispanic Index of Consumer Sentiment

- 2022 Hispanic Index of Consumer Sentiment

- 2021 Hispanic Index of Consumer Sentiment

- 2020 Hispanic Index of Consumer Sentiment

- 2019 Hispanic Index of Consumer Sentiment

- 2018 Hispanic Index of Consumer Sentiment

- 2017 Hispanic Index of Consumer Sentiment

- 2016 Hispanic Index of Consumer Sentiment

- 2015 Hispanic Index of Consumer Sentiment

- 2014 Hispanic Index of Consumer Sentiment

2019 Hispanic Index of Consumer Sentiment

Fourth Quarter 2019

HISPANICS CONSUMER CONFIDENCE IS WEAKER GOING INTO 2020

- In the fourth quarter, 66% of Hispanics said they are better off financially today

than a year ago compared to 70% in the third quarter, which is a decrease of 4 points.

o Hispanics between 18-34 year old (74%) and those between 35-54 year old (66%) are more optimistic of their current financial situation than those above 55 years old (50%).

- In the fourth quarter, 73% of Hispanics said they expect to be better off financially

in the next year compared to 74% in the third quarter, which is a decrease of 1 point.

o Hispanics between 18-34 year old (76%) and those between 35-54 year old (75%) are more optimistic of optimistic of their financial situation in the future than those above 55 years old (61%).

- Regarding the short run economic outlook of the country, 65% of Hispanics said that

they expect the country to experience good business conditions in the upcoming year;

down 1 point compared to the third quarter (quarter 3 was 66%).

o Hispanics between 18-34 year old (71%) and those between 35-54 year old (68%) are more optimistic of short run economic outlook than those above 55 years old (48%).

- In terms of long run economic outlook of the country, 65% of Hispanics said that they

expect the economic outlook of the country to be good in the next five years, down

7 points compared to the third quarter (q3=72%).

o Hispanics between 18-34 year old (71%) and those between 35-54 year old (67%) are more optimistic of the long run economic outlook than those above 55 years old (48%).

- Overall, in the third quarter 65% of Hispanics think it is good time to buy big ticket

items compared to 69% percent in the third quarter, which is a decrease of 4 points.

o Hispanics between 18-34 year old (68%) and those between 35-54 year old (65%) are more optimistic of buying big ticket items for their homes than those above 55 years old (60%).

Other key findings:

- Buying a House: In the fourth quarter 63% of Hispanics think it is a good time to buy a house compared to 42% in the third quarter.

- Buying a Car: In the fourth quarter, 66% of Hispanics think it is a good time to buy a car compared to 59% in the third quarter.

- Cost of living: In the fourth quarter, 59% of Hispanics said the cost of living has gone up compared to 82% in the third quarter.

- It appears that Hispanics’ decrease in optimism their personal finances and decrease in optimism on the economic outlook of the country has also affected President Trump’s approval rating which saw a decrease of 13 points to a 42% approval compared to 55% in the previous quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The

survey was administered using both landlines via IVR data collection and online data

collection using Dynata. There were 642 respondents sampled between October 1 and December 31, 2019 and a

margin of error of +/- 3.87 percentage points. Responses for the entire sample were

weighted to reflect the national distribution of the Hispanic population by region,

education, gender, and age according to latest American Community Survey data.

Third Quarter 2019

HISPANICS CONSUMER CONFIDENCE INCREASES IN THE THIRD QUARTER

Overall, there is an increase in optimism in all the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the second quarter of 2019. Below are the detailed results:

- In the third quarter of 2019, 70% of Hispanics said they are better off financially

than a year ago compared to 68% in the second quarter.

o Women are more optimistic of their current financial situation compared to men (78% vs. 63%).

o Hispanics between 18-34 year old (85%) and those between 35-54 year old (71%) are more optimistic of their current financial situation than those above 55 years old (41%).

- In the third quarter of 2019, 74% of Hispanics indicated they will be better off over

in a year from now compared to 70% in the previous quarter.

o Women are more optimistic of their financial situation in the future compared to men (80% vs. 68%).

o Hispanics between 18-34 year old (91%) and those between 35-54 year old (77%) are more optimistic of their financial situation in the future than those above 55 years old (36%).

- Regarding the short run economic outlook of the country, 66% of Hispanics said they

expect the country as a whole to experience good business conditions in the upcoming

year compared to 59% in the second quarter.

o Women are more optimistic of short run economic outlook of the country compared to men (70% vs. 63%).

o Hispanics between 18-34 year old (79%) and those between 35-54 year old (69%) are more optimistic of the short run economic outlook of the country than those above 55 years old (36%).

- In terms of long run economic outlook of the country, 72% of Hispanics are optimistic

of the long run economic outlook of the country compared to 56% in the previous quarter.

o Women are more optimistic of the long run economic outlook of the country compared to men (75% vs. 69%).

o Hispanics between 18-34 year old (80%) and those between 35-54 year old (72%) are more optimistic of the long run economic outlook of the country than those above 55 years old (57%).

- In the third quarter of 2019, 69% percent of Hispanics think it is good time to buy

big ticket items compared to 61% percent in the first quarter.

o More women think it is good time to buy big ticket items compared to men (74% vs. 65%).

o Hispanics between 18-34 year old (82%) and those between 35-54 year old (72%) are more optimistic that it is a good time to buy big ticket than those above 55 years old (41%).

-

Cost of living: 82.3% of Hispanics said the cost of living has gone up compared to 65% in the previous quarter.

-

Buying a Car: 59% of Hispanics think it is a good time to buy a car compared to 67% in the previous quarter.

-

Buying a House: 43% of Hispanics think it is a good time to buy a house compared to 69% in the previous quarter.

-

President Trump approval rating: President Trump’s disapproval rating is 45% compared to 66% in the previous quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Survey Sampling International SSI. There were 650 respondents sampled between July 1 and September 30, 2019 and a margin of error of +/- 3.84 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, and age according to latest American Community Survey data.

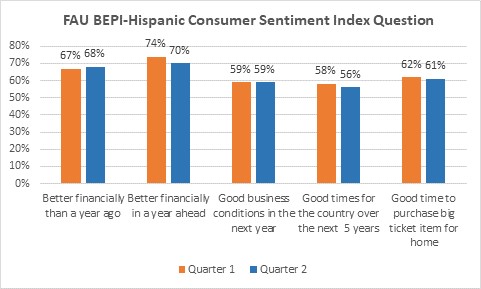

Second Quarter 2019

Hispanics Consumer Confidence Slightly Drops in The Second Quarter

Overall, there is a drop in optimism in three out of the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the first quarter of 2019. Below are the detailed results:

- In the second quarter of 2019, 68% of Hispanics said they are better off financially

than a year ago compared to 67% in the first quarter.

o Women are more optimistic of their current financial situation compared to men (70% vs. 67%).

o Hispanics between 18-34 year old (79%) and those between 35-54 year old (61%) are more optimistic of their current financial situation than those above 55 years old (59%).

- In the second quarter of 2019, 70% of Hispanics indicated they will be better off

over in a year from now compared to 74% in the previous quarter.

o Hispanics between 18-34 year old (71%) and those between 35-54 year old (72%) are more optimistic of their financial situation in the future than those above 55 years old (65%).

o Hispanics that self-identified as Democrats (75%) are more optimistic of their financial situation in the future compared to Republicans, Independents and not registered voters (Republicans (69%), Independents (67%) and not registers (63%).

- Regarding the short run economic outlook of the country, 59% of Hispanics said they

expect the country as a whole to experience good business conditions in the upcoming

year; which is roughly the same value as in the first quarter.

o Women are more optimistic of short run economic outlook of the country compared to men (62% vs. 56%).

o Hispanics between 18-34 year old (72%) and those between 35-54 year old (52%) are more optimistic of the short run economic outlook of the country than those above 55 years old (42%).

- In terms of long run economic outlook of the country, 56% of Hispanics are optimistic

of the long run economic outlook of the country compared to 58% in the previous quarter.

o Men are more optimistic of the long run economic outlook of the country compared to women (60% vs. 53%).

o Hispanics that self-identified as Republicans (77%) are more optimistic of the long run economic outlook of the country compared to Democrats, Independents and not registered (Democrats (52%), Independents (43%) and not registered voters (48%).

- In the second quarter of 2019, 61% percent of Hispanics think it is good time to buy

big ticket items compared to 62% percent in the first quarter.

o More women think it is good time to buy big ticket items compared to men (66% vs. 56%).

o Hispanics between 18-34 year old (68%) and those between 35-54 year old (57%) are more optimistic that it is a good time to buy big ticket than those above 55 years old (53%)

Other key findings:

- Cost of living: 65% of Hispanics said the cost of living has gone up compared to 71% in the previous quarter.

- Buying a Car: 67% of Hispanics think it is a good time to buy a car compared to 61% in the previous quarter.

- Buying a House: 69% of Hispanics think it is a good time to buy a house compared to 57% in the previous quarter.

- President Trump approval rating: President Trump’s approval rating drops 3 points from 37% in first quarter to a 34% approval rating in the second quarter of 2019.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Survey Sampling International SSI. There were 510 respondents sampled between April 1 and June 30, 2019 and a margin of error of +/- 4.34 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, and age according to latest American Community Survey data.

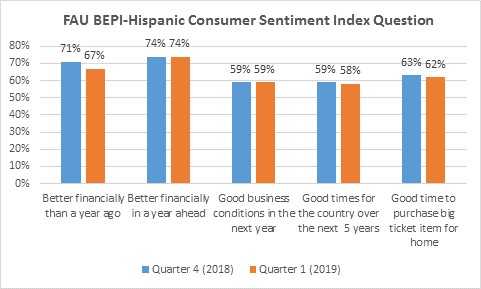

First Quarter 2019

Hispanics’ Consumer Confidence Drops Slightly in First Quarter as Political Divisions Show in Economic Expectations

The Hispanic Consumer Sentiment Index (HCSI) in the first quarter of 2019 finds that the Hispanic population’s consumer confidence in the U.S. has slightly dropped compared to the fourth quarter of 2018. Specifically, the Hispanic Consumer Sentiment Index (HCSI) dropped from 98.5 in the fourth quarter of 2018 to a 96.6 in the first quarter of 2019. The HCSI is 2 points higher than the general population first quarter average of 94.5 as published by the University of Michigan.

Overall, there is a slight drop in optimism in three out of the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the fourth quarter of 2018. Below are the detailed results:

-

In the first quarter of 2019, only 67% of Hispanics said they are better off financially than a year ago compared to 71% in the last quarter of 2018.

o Men are more optimistic of their current financial situation compared to women (74% vs. 60%).o Hispanics between 18-34 year old (68%) and those between 35-54 year old (70%) are more optimistic of their current financial situation than those above 55 years old (60%).

-

In the first quarter of 2019, 74% of Hispanics indicated they will be better off over the next year; which is roughly the same value as in the last quarter of 2018.

o Men are more optimistic of their future financial situation compared to women (78% vs. 70%).o Hispanics that self-identified as Republicans (82%) are more optimistic of their future financial situation compared to Democrats,Independents and not registered voters (Democrats (68%), Independents (72%) and not registers (77%).

- Regarding the short run economic outlook of the country, 59% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year; which is roughly the same value as in the fourth quarter of 2018.

- In terms of long run economic outlook of the country, Hispanics are slightly less optimistic in the first quarter compared to the fourth quarter of 2018 (58% vs. 59%).

- In the first quarter of 2019, 62% percent of Hispanics think it is good time to buy big ticket items compared to 63% percent in the fourth quarter of 2018.

Other key findings:

- Cost of living: 71% of Hispanics said the cost of living has gone up, this an increase of 6 points compared to the fourth quarter of 2018 (65%).

- Buying a Car: Due to the perceptions of increase in the cost of living, only 61% of Hispanics think it is a good time to buy a car compared to 63% in the last quarter of 2018.

- President Trump approval rating: President Trump’s approval rating drops of 3 points from 40% in last quarter of 2018 to a 37% approval in the first quarter of 2019.

o Hispanics that self-identified as Republicans (63%) have a higher approval rating of President Trump’s performance compared to Democrats, Independents and not registered (Democrats (30%), Independents (29%) and not registered voters (21%).

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Survey Sampling International SSI. There were 640 respondents sampled between January 1 and March 31, 2019 and a margin of error of +/- 3.87 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, and age according to latest American Community Survey data.