Executive Master of Accounting (EMAC) Professional Accounting Concentration

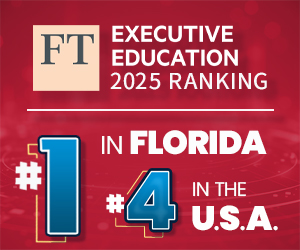

The Executive Master of Accounting (EMAC) with a concentration in Professional Accounting program is offered by the Executive Education Department in FAU’s AACSB-accredited College of Business. The Professional Accounting concentration is tailored to the needs of busy professionals and is our most popular concentration for students looking to sit for the Certified Public Accountant (CPA) exam. Through tailored coursework, students gain expertise in areas such as financial accounting, taxation, auditing, and managerial accounting.

Most students complete the program in two years while working full-time, although students with an undergraduate degree in accounting have the option of completing the program in as few as three semesters. The curriculum allows non-accounting undergraduate degreed students to complete the program by taking two to five additional courses built into the schedule. Therefore, prerequisites are not required outside of the program.

The program aims to provide flexibility and engagement by offering a combination of fully online, live-virtual and optional in-person once-a-month, to accommodate students’ commitments and preferences. Students can choose to attend the lectures synchronously and asynchronously. Those unable to join us once-a-month in person, or attend the live sessions on Saturdays, can still access the lecture recordings and benefit from the same content to complete the program 100% online. Attend your way!

Attendance Format:

- Fully Online: Access to recorded lectures 24/7

- Asynchronous, no set times for class attendance

- Live-Streamed: Weekly live-streamed lectures on Saturday mornings from anywhere around the world

- On-Campus: Attend optional in-person lectures (3 - 4 times per semester) on our Davie Campus once-a-month on Saturday (requires health immunization forms)

- Combine all three options at no extra cost to you

Program Duration:

- 12 – 36 months (1 - 3 years)

- 10 – 15 courses / 30 - 45 credits

Course Schedule and Time:

- Fall semesters: 2 courses (16 weeks)

- Spring semesters: 2 courses (16 weeks)

- Summer semesters: 1 course (12 weeks)

- Saturdays: 9:00 AM – 1:15 PM

- Lecture duration: 1 hour and 15 minutes per course

Optional Once-a-month Class Location:

- Join us on the FAU Davie Campus, in the state-of-the-art Davie West Facility

- Breakfast and lunch included

Professional Accounting Curriculum

Accounting Major

Advanced Accounting Theory (ACG 6135) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 6137 or ACG

3141. Prerequisite or Corequisite: Writing for Professional Accounting.

Analysis of trends in accounting through review of the major publications of the accounting

profession. Emphasis on the structure of accounting theory underlying the concepts

of assets and income determination.

Advanced Financial Reporting and Accounting Concepts (ACG 6138) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 3141 or ACG

6137. Prerequisite or Corequisite: Writing for Professional Accounting.

Course is a study of advanced topics in financial reporting and accounting and focuses

on complex corporate reporting issues. The course is not only a study of financial

reporting and disclosure requirements, but also includes controversial and emerging

practices.

Advanced Accounting Information Systems (ACG 6475) 3 credits

Prerequisites: Admission to master's program in Accounting or permission of instructor

and ACG 2021 or ACG 6027. Prerequisite or Corequisite: Writing for Professional Accounting.

The study of computerized accounting information systems with emphasis on reporting

objectives, management needs, transaction trails, documentation, security, internal

controls, and the integration of accounting systems in the evaluation and selection

of software. Systems analysis techniques are discussed using the systems development

life cycle model.

Advanced Auditing Theory and Practice (ACG 6655) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A study of the concepts, assumptions, standards, and issues related to contemporary

auditing theory and practice.

*Concepts of Federal Income Tax (TAX 6025) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Analysis of the principles of the Federal Income Tax. The relationship among statutes,

case law, congressional committee reports, and administrative pronouncements is emphasized.

A case approach is used. This course is not available to students who have completed TAX 4001 and 4011.

Or

*ACG 6689 is substituted for TAX 6025

Forensic Accounting, Fraud and Taxation (ACG 6689) 3 credits

Prerequisites: ACG 2021 or ACG 6027.

Overview of the nature of tax fraud, its motivation, the manner by which it is effected,

and ways to detect this type of fraud. Also discussed is the proper manner in which

allegations of fraud should be investigated to meet the requirements of civil/criminal

court procedure.

Financial Statement Analysis (ACG 6175) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 3141 or ACG

6137 and FIN 6406.

The analysis of accounting data for purposes of auditing, fraud detection, credit

and investment decisions, including bankruptcy prediction models and earnings‐based

equity valuation.

*Government Accounting Theory (ACG 5505) 3 credits

Prerequisites: ACG 3141 or ACG 6137 and ACG 3341 or ACG 6347.

A study of information presented in the various financial statements and other reports

of governmental units. Detailed review of the authoritative bodies influencing the

accounting and reporting for state and local governmental entities. This course is not available to students who have completed ACG 4501.

Or

*TAX 6065 or TAX 6105 is substituted for ACG 5505

Tax Research (TAX 6065) 3 credits

Prerequisites: Graduate standing and TAX 6025 or TAX 4001.

Methods of researching tax problems and practical exercises in the uses of research

tools in locating, understanding, and interpreting source materials.

IT Auditing (ACG 6625) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A survey of control and auditing techniques employed in computer‐based accounting

systems.

Communication Strategies for Professional Accountants (ACG 6396-XPRO) 3 credits

Prerequisite: Admission to master's program in Accounting.

This course places students in a semester‐long project that simulates situations encountered

by accountants in their careers. It prepares them to respond strategically and professionally

to various stakeholders to: (a) think critically, (b) write accurately and concisely,

and (c) speak effectively and confidently.

Accounting for E‐Commerce (ACG 6465) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 2021 or ACG

6027.

This course covers e‐commerce topics of relevance for accounting and business students.

Topics include e-commerce security, attestation issues, XML, e‐commerce taxation,

and e‐commerce business valuation.

Or

Accounting Fraud Examination Concepts (ACG 6686) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Overview of the nature of occupational fraud and how it is committed including an

introduction to the actions that can be taken to determine the presence of occupational

fraud and the procedures that can be implemented to deter it. Also covered is the

proper manner in which allegations of fraud should be investigated to meet the requirements

of civil/criminal court procedure.

Business Major

Financial Reporting and Accounting Concepts (ACG 6137) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Course covers conceptual and applied issues in financial accounting. Students learn

to apply basic research skills in financial accounting with authoritative accounting

literature. This course is not available to students who have completed ACG 3131 and 3141.

Cost Accounting Theory and Practice (ACG 6347) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Accounting topics for managers, including budgeting, performance measurement, cost

analysis, balance scorecards, activity-based costing, and cost functions. This course is not available to students who have completed ACG 3341.

Auditing Theory and Practice (ACG 6635) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 4401 or ACG

6475 and ACG 3141 or ACG 6137.

A study of the role of audits in society, the regulations of the auditing profession,

current issues in the profession, and the conduct of an attestation engagement. This course is not available to students who have completed ACG 4651.

Advanced Accounting Theory (ACG 6135) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 6137 or ACG

3141. Prerequisite or Corequisite: Writing for Professional Accounting.

Analysis of trends in accounting through review of the major publications of the accounting

profession. Emphasis on the structure of accounting theory underlying the concepts

of assets and income determination.

Advanced Financial Reporting and Accounting Concepts (ACG 6138) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 3141 or ACG

6137. Prerequisite or Corequisite: Writing for Professional Accounting.

Course is a study of advanced topics in financial reporting and accounting and focuses

on complex corporate reporting issues. The course is not only a study of financial

reporting and disclosure requirements, but also includes controversial and emerging

practices.

Advanced Accounting Information Systems (ACG 6475) 3 credits

Prerequisites: Admission to master's program in Accounting or permission of instructor

and ACG 2021 or ACG 6027. Prerequisite or Corequisite: Writing for Professional Accounting.

The study of computerized accounting information systems with emphasis on reporting

objectives, management needs, transaction trails, documentation, security, internal

controls, and the integration of accounting systems in the evaluation and selection

of software. Systems analysis techniques are discussed using the systems development

life cycle model.

Advanced Auditing Theory and Practice (ACG 6655) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A study of the concepts, assumptions, standards, and issues related to contemporary

auditing theory and practice.

Concepts of Federal Income Tax (TAX 6025) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Analysis of the principles of the Federal Income Tax. The relationship among statutes,

case law, Congressional committee reports, and administrative pronouncements is emphasized.

A case approach is used.

Financial Statement Analysis (ACG 6175) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 3141 or ACG

6137 and FIN 6406.

The analysis of accounting data for purposes of auditing, fraud detection, credit

and investment decisions, including bankruptcy prediction models and earnings-based

equity valuation.

Governmental and Not-for-Profit Accounting Theory (ACG 5505) 3 credits

Prerequisites: ACG 3141 or ACG 6137 or equivalent and ACG 3341 or ACG 6347 or equivalent.

A study of information presented in financial statements/other reports of governmental

units and not-for-profit entities and associated authoritative literature. Not available to students who have completed ACG 4501 or its equivalent.

IT Auditing (ACG 6625) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A survey of control and auditing techniques employed in computer-based accounting

systems.

Accounting Fraud Examination Concepts (ACG 6686) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027 and BUL 4422.

Overview of the nature of occupational fraud and how it is committed including an

introduction to the actions that can be taken to determine the presence of occupational

fraud and the procedures that can be implemented to deter it. Also covered is the

proper manner in which allegations of fraud should be investigated to meet the requirements

of civil/criminal court procedure.

Communication Strategies for Professional Accountants (ACG 6396-XPRO) 3 credits

Prerequisite: Admission to master's program in Accounting.

This course places students in a semester-long project that simulates situations encountered

by accountants in their careers. It prepares them to respond strategically and professionally

to various stakeholders to: (a) think critically, (b) write accurately and concisely,

and (c) speak effectively and confidently.

Non-Business Major

Financial Accounting Concepts (ACG 6027) 3 credits

Prerequisite: Graduate standing.

Principles applicable to the accounting cycle, asset valuation, income determination,

financial reporting, basic business taxes, and owner's equity. Available only to graduate students lacking an undergraduate course in accounting

(ACG 2021).

Financial Management (FIN 6406) 3 credits

Prerequisites: Graduate standing, financial accounting principles.

Tools and applications of financial analysis and forecasting, investment policy, financing

policy, and working capital policy. Open only to graduate students lacking an undergraduate course in Finance (FIN 3403).

Financial Reporting and Accounting Concepts (ACG 6137) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Course covers conceptual and applied issues in financial accounting. Students learn

to apply basic research skills in financial accounting with authoritative accounting

literature. This course is not available to students who have completed ACG 3131 and 3141.

Cost Accounting Theory and Practice (ACG 6347) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Accounting topics for managers, including budgeting, performance measurement, cost

analysis, balance scorecards, activity-based costing, and cost functions. This course is not available to students who have completed ACG 3341.

Auditing Theory and Practice (ACG 6635) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 4401 or ACG

6475 and ACG 3141 or ACG 6137

A study of the role of audits in society, the regulations of the auditing profession,

current issues in the profession, and the conduct of an attestation engagement. This course is not available to students who have completed ACG 4651.

Advanced Accounting Theory (ACG 6135) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 6137 or ACG

3141. Prerequisite or Corequisite: Writing for Professional Accounting.

Analysis of trends in accounting through review of the major publications of the accounting

profession. Emphasis on the structure of accounting theory underlying the concepts

of assets and income determination.

Advanced Financial Reporting and Accounting Concepts (ACG 6138) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 3141 or ACG

6137. Prerequisite or Corequisite: Writing for Professional Accounting.

Course is a study of advanced topics in financial reporting and accounting and focuses

on complex corporate reporting issues. The course is not only a study of financial

reporting and disclosure requirements, but also includes controversial and emerging

practices.

Advanced Accounting Information Systems (ACG 6475) 3 credits

Prerequisites: Admission to master's program in Accounting or permission of instructor

and ACG 2021 or ACG 6027.Prerequisite or Corequisite: Writing for Professional Accounting.

The study of computerized accounting information systems with emphasis on reporting

objectives, management needs, transaction trails, documentation, security, internal

controls, and the integration of accounting systems in the evaluation and selection

of software. Systems analysis techniques are discussed using the systems development

life cycle model.

Advanced Auditing Theory and Practice (ACG 6655) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A study of the concepts, assumptions, standards, and issues related to contemporary

auditing theory and practice.

Concepts of Federal Income Tax (TAX 6025) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027.

Analysis of the principles of the Federal Income Tax. The relationship among statutes,

case law, Congressional committee reports, and administrative pronouncements is emphasized.

A case approach is used.

Financial Statement Analysis (ACG 6175) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 3141 or ACG

6137 and FIN 6406.

The analysis of accounting data for purposes of auditing, fraud detection, credit

and investment decisions, including bankruptcy prediction models and earnings-based

equity valuation.

Governmental and Not-for-Profit Accounting Theory (ACG 5505) 3 credits

Prerequisites: ACG 3141 or ACG 6137 or equivalent and ACG 3341 or ACG 6347 or equivalent.

A study of information presented in financial statements/other reports of governmental

units and not-for-profit entities and associated authoritative literature. Not available to students who have completed ACG 4501 or its equivalent.

IT Auditing (ACG 6625) 3 credits

Prerequisite: Admission to College of Business master's program and ACG 4651 or ACG

6635.

A survey of control and auditing techniques employed in computer-based accounting

systems.

Accounting Fraud Examination Concepts (ACG 6686) 3 credits

Prerequisites: Admission to College of Business master's program and ACG 2021 or ACG

6027 and BUL 4422.

Overview of the nature of occupational fraud and how it is committed including an

introduction to the actions that can be taken to determine the presence of occupational

fraud and the procedures that can be implemented to deter it. Also covered is the

proper manner in which allegations of fraud should be investigated to meet the requirements

of civil/criminal court procedure.

Communication Strategies for Professional Accountants (ACG 6396-XPRO) 3 credits

Prerequisite: Admission to master's program in Accounting.

This course places students in a semester-long project that simulates situations encountered

by accountants in their careers. It prepares them to respond strategically and professionally

to various stakeholders to: (a) think critically, (b) write accurately and concisely,

and (c) speak effectively and confidently.

According to the 2015 Compensation Survey conducted by the American Institute of Certified Accountants (AICPA), the mean total compensation for CPAs is $198,400. Of course, total compensation can vary dramatically based on the length of one’s career, position within the firm or organization, and many other factors. CPAs work in all sectors of the economy, public accounting, government, and in private companies.