- 2024 Hispanic Index of Consumer Sentiment

- 2023 Hispanic Index of Consumer Sentiment

- 2022 Hispanic Index of Consumer Sentiment

- 2021 Hispanic Index of Consumer Sentiment

- 2020 Hispanic Index of Consumer Sentiment

- 2019 Hispanic Index of Consumer Sentiment

- 2018 Hispanic Index of Consumer Sentiment

- 2017 Hispanic Index of Consumer Sentiment

- 2016 Hispanic Index of Consumer Sentiment

- 2015 Hispanic Index of Consumer Sentiment

- 2014 Hispanic Index of Consumer Sentiment

2022 Hispanic Index of Consumer Sentiment

Fourth Quarter 2022

HISPANICS' CONSUMER CONFIDENCE IS SLIGHTLY STRONGER GOING INTO 2023

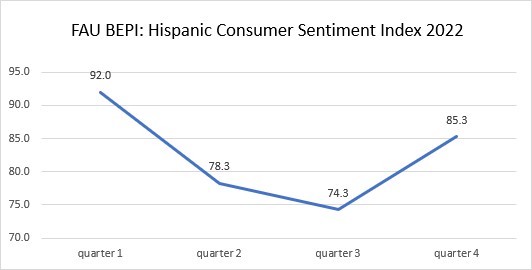

Hispanics in the United States feel more optimistic about their financial situations as they go into 2023. The fourth quarter Hispanic Consumer Sentiment Index (HCSI) is at 85.3, which is 11 points higher compared to the third quarter score of 74.3. The HCSI finished lower in the fourth quarter compared to the first quarter of 2022 but higher than the second and third quarter. The same trend is true for the general population’s consumer confidence index published by the University of Michigan.

Overall, the majority of Hispanics are more optimistic about their financial situations going into 2023. Below are the detailed results of the five questions used to generate the Hispanic Consumer Sentiment Index:

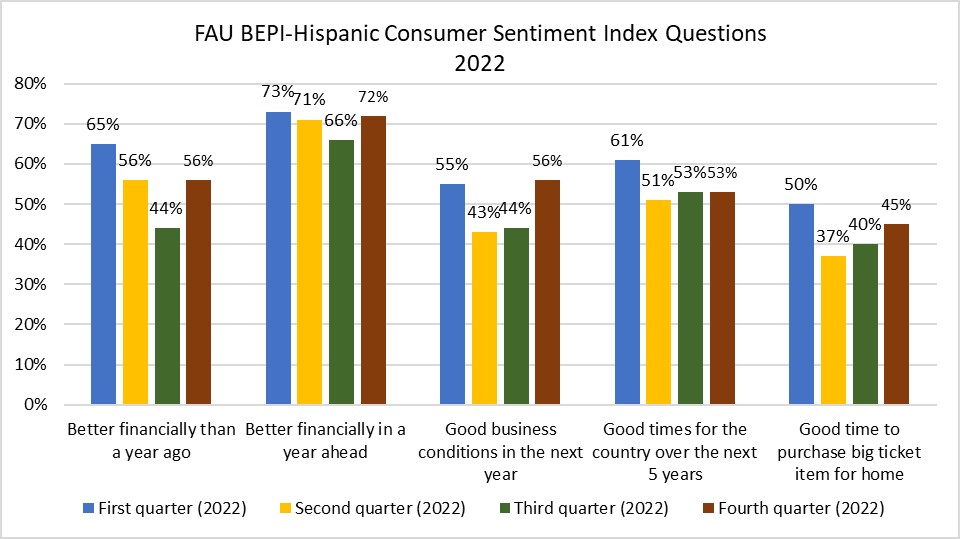

- In the fourth quarter, 56% of Hispanics said they are better off financially today than a year ago compared to 44% in the third quarter.

-

- Women are more optimistic of their current financial situation compared to men (57%

vs. 43%).

- Women are more optimistic of their current financial situation compared to men (57%

vs. 43%).

- In the fourth quarter, 72% of Hispanics said they expect to be better off financially in the next year compared to 66% in the third quarter.

-

- Women are more optimistic of their financial situation in the future compared to men

(79% vs. 67%).

- Women are more optimistic of their financial situation in the future compared to men

(79% vs. 67%).

- Regarding the short run economic outlook of the country, 56% of Hispanics said that they expect the country to experience good business conditions in the upcoming year compared to 44% in the previous quarter.

-

- Women are more optimistic of the short run economic outlook of the country compared

to men (66% vs. 47%).

- Women are more optimistic of the short run economic outlook of the country compared

to men (66% vs. 47%).

- In terms of long run economic outlook of the country, 53% of Hispanics said that they expect the economic outlook of the country to be good in the next five years which remains unchanged from the previous quarter.

-

- Men are more optimistic of the long run economic outlook of the country compared to

women (54% vs. 53%).

- Men are more optimistic of the long run economic outlook of the country compared to

women (54% vs. 53%).

- Overall, in the fourth quarter 45% of Hispanics think it is a good time to buy big ticket items compared to 40% percent in the third quarter.

-

- Women are more optimistic of buying big ticket items for their home compared to men (48% vs. 43%).

Other key findings:

-

Buying a House: In the fourth quarter 37% of Hispanics think it is a good time to buy a house compared to 26% in the third quarter.

-

Buying a Car: In the fourth quarter, 42% of Hispanics think it is a good time to buy a car compared to 43% in the third quarter.

- Cost of living: In the fourth quarter, 78% of Hispanics said the cost of living has gone up compared to 81% in the third quarter.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 466 respondents sampled between October 1 and December 31, 2022 and a margin of error of +/- 3.54 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by gender, age, education, and income according to latest American Community Survey data.

Third Quarter 2022

Hispanics' Consumer Confidence Slightly Decreased in the Third Quarter of 2022

The Hispanic Consumer Sentiment Index (HCSI) in the third quarter of 2022 finds that the Hispanic population’s consumer confidence in the U.S. decreased compared to the second quarter. Specifically, the Hispanic Consumer Sentiment Index (HCSI) decreased from 78.3 in the second quarter of 2022 to 74.3 in the third quarter.

Overall, there is slight decrease in optimism in two out of the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the second quarter of 2022. Below are the detailed results:

-

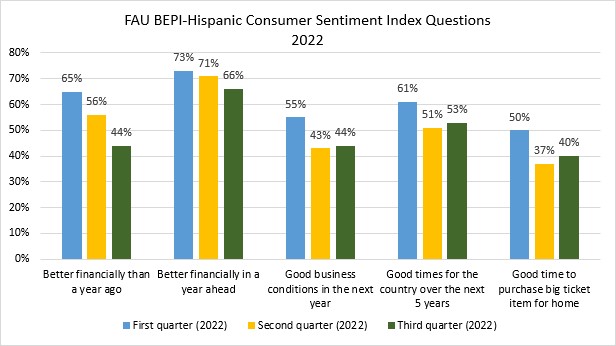

In the third quarter of 2022, 44% of Hispanics said they are better off financially than a year ago compared to 56% in the second quarter and 65% in the first quarter of 2022.

-

-

Hispanics between 18-34 years old (50%) and those above 55 years old (43%) are more optimistic of their current financial situation than those between 35-54 years old (38%).

-

-

In the third quarter of 2022, 66% of Hispanics are more optimistic of their future financial situation compared to 71% in the second quarter and 73% in the first quarter of 2022.

-

-

Hispanics between 18-34 years old (68%) and those above 55 years old (80%) are more optimistic of their future financial situation than those between 35-54 years old (58%).

-

-

Regarding the short run economic outlook of the country, 44% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared to 43% in the second quarter and 55% in the first quarter of 2022.

-

-

Hispanics between 18-34 years old (40%) and those above 55 years old (73%) are more optimistic of the short run economic outlook of the country than those between 35-54 years old (35%).

-

-

In terms of long run economic outlook of the country, 53% of Hispanics slightly more optimistic compared to 51% in the second quarter and 61% in the first quarter of 2022.

- In the third quarter of 2022, 40% percent of Hispanics think it is good time to buy big- ticket items compared to 37% percent in the second quarter and 50% in the first quarter of 2022.

Other key findings:

-

Cost of living: 81% of Hispanics said the cost of living has gone up compared to 80% in the second quarter and 81% in the first quarter of 2022.

-

Buying a house: 26% Hispanics think it is good time to buy a house compared to 30% in the second quarter and 49% in the first quarter of 2022.

-

Buying a Car: 43% Hispanics think it is a good time to buy a car compared to 34% in the second quarter and 53% in the first quarter of 2022.

The survey is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 454 respondents sampled between July 1 and September 30, 2022 with a margin of error of +/- 4.59 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data.

Second Quarter 2022

U.S Hispanic Consumer Confidence Plunges

The Hispanic Consumer Sentiment Index (HCSI) in the second quarter of 2022 finds that the Hispanic population’s consumer confidence in the U.S. has significantly decreased compared to the first quarter. Specifically, the Hispanic Consumer Sentiment Index (HCSI) decreased from 92.0 in the first quarter of 2022 to 78.3 in the second quarter.

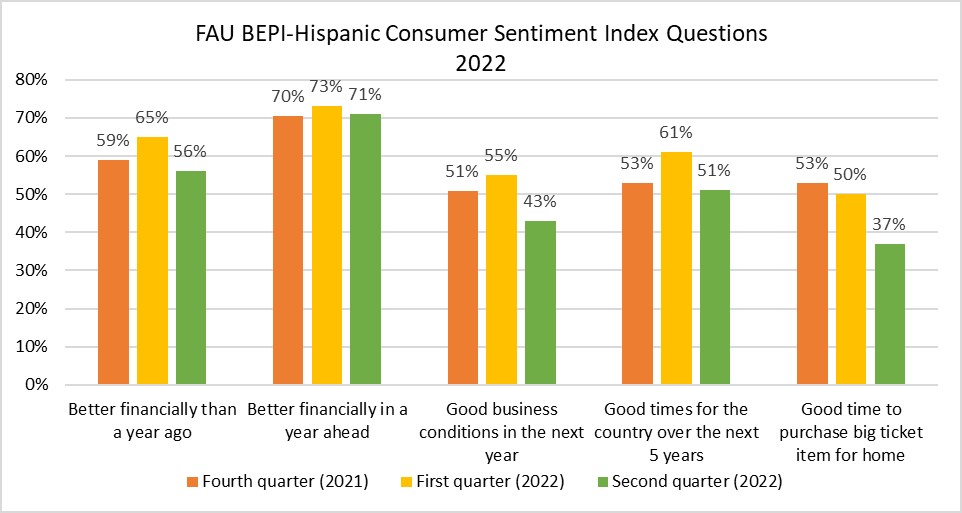

Overall, there is a decrease in optimism in the five questions used to generate the Hispanic Consumer Sentiment Index when compared to the first quarter of 2022. Below are the detailed results:

-

In the second quarter of 2022, 56% of Hispanics said they are better off financially than a year ago compared to 65% in the first quarter and 59% in the last quarter of 2021.

-

In the second quarter of 2022, 71% of Hispanics are slightly more optimistic of their future financial situation compared to 73% in the first quarter and 70% in the last quarter of 2021.

-

Regarding the short run economic outlook of the country, 43% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared to 55% in the first quarter and 51% in the last quarter of 2021.

-

In terms of long run economic outlook of the country, 51% of Hispanics are less optimistic year compared to 61% in the first quarter and 53% in the last quarter of 2021.

-

In the second quarter of 2021, 37% percent of Hispanics think it is good time to buy big- ticket items compared to 50% percent in the first quarter and 53% in the last quarter of 2021.

Other key findings:

-

Cost of living: 80% of Hispanics said the cost of living has gone up compared to 81% in the previous quarter and 70% in the last quarter of 2021.

-

Buying a house: 30% of Hispanics think it is good time to buy a house compared to 49% in the in the previous quarter and 46% in the last quarter of 2021.

- Buying a Car: 34% of Hispanics think it is a good time to buy a car compared to 53% in the previous quarter and in the last quarter of 2021.

The survey is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 493 respondents sampled between April 1 and June 30, 2022 with a margin of error of +/-4.41 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data.

First Quarter 2022

HISPANICS MORE OPTIMISTIC ABOUT THEIR PERSONAL FINANCES

The Hispanic Consumer Sentiment Index (HCSI) in the first quarter of 2022 finds that the Hispanic population’s consumer confidence in the U.S. has increased compared with the fourth quarter of 2021. Specifically, the HCSI increased from 86.7 in the fourth quarter of 2021 to 92.0 in the first quarter of 2022.

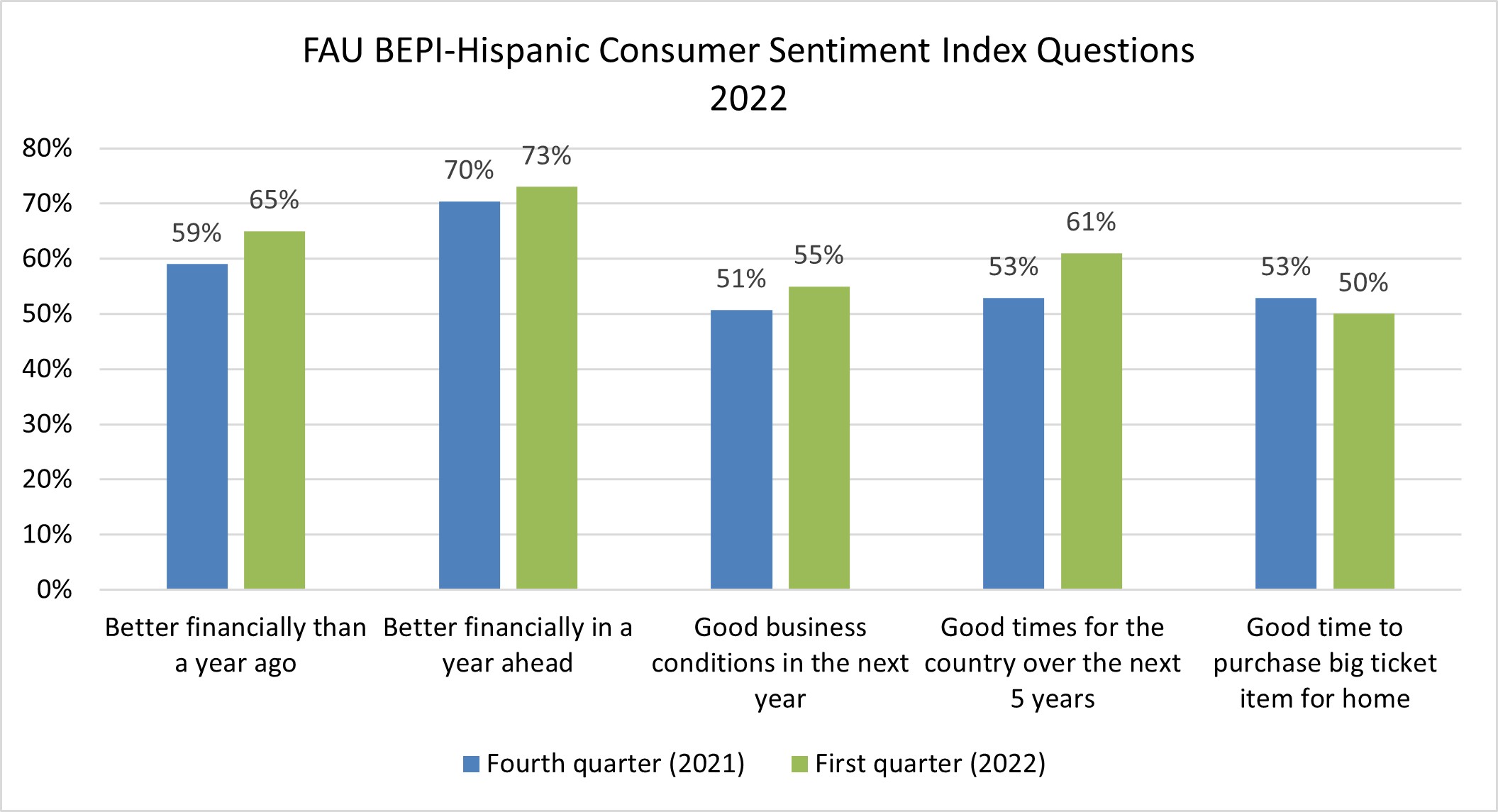

Overall, there is an increase in optimism in four out of the five questions used to generate the HCSI when compared with the fourth quarter of 2021. Below are the detailed results:

- In the first quarter of 2022, 65% of Hispanics said they are better off financially

than a year ago, which is 6 percentage points higher (59%) than last quarter of 2021.

- Men are more optimistic of their current financial situation compared to women (72%

vs. 57%).

- Men are more optimistic of their current financial situation compared to women (72%

vs. 57%).

- In the first quarter of 2022, 73% of Hispanics indicated they will be better off over

the next year compared with 70% in the last quarter of 2021.

- Hispanics between 18-34 year old (82%) are more optimistic of their future financial

situation than those between 35-54 year old (78%) are those above 55 years old (43%).

- Hispanics between 18-34 year old (82%) are more optimistic of their future financial

situation than those between 35-54 year old (78%) are those above 55 years old (43%).

-

Regarding the short run economic outlook of the country, 55% of Hispanics said they expect the country as a whole to experience good business conditions in the upcoming year compared with 51% in the fourth quarter of 2021.

-

Hispanics between 18-34 year old (61%) are more optimistic of the short-run economic outlook of the country than those between 35-54 year old (63%) are those above 55 years old (28%).

-

-

In terms of long-run economic outlook of the country, Hispanics are more optimistic in the first quarter of 2022 compared with the fourth quarter of 2021 (61% vs. 53%).

-

Women are more optimistic of the long-run economic outlook compared with men (43% vs. 35%).

-

- In the first quarter of 2022, 50% percent of Hispanics think it is good time to buy

big ticket items for the home compared with 53% percent in the fourth quarter of 2021.

- Men are more optimistic that it is a good time to buy big ticket than women (60% vs. 40%)

Other key findings:

- Buying a house: 49% of Hispanics think it is good time to buy a house compared to 46% in the last

quarter of 2021.

- Buying a car: 53% of Hispanics think it is a good time to buy a car which is the same as in the

last quarter of 2021.

- Cost of living: 81% of Hispanics said the cost of living has gone up compared with 70% in the last quarter of 2021.

The poll is based on a panel sample of Hispanic adults, 18 years of age and older. The survey was administered using both landlines via IVR data collection and online data collection using Dynata. There were 612 respondents sampled between January 1 and March 31, 2022 and a margin of error of +/- 3.96 percentage points. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, education, gender, age and income according to latest American Community Survey data. The polling results and full cross-tabulations can be viewed on the FAU BEPI Website.