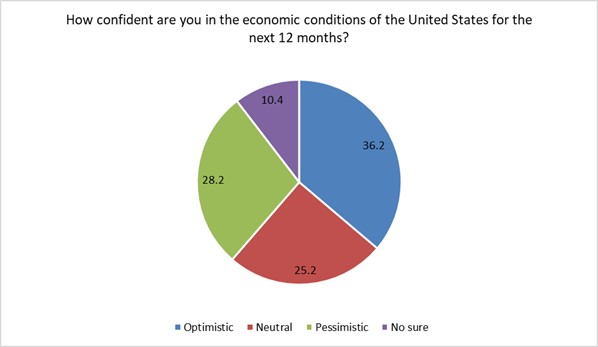

Floridians Bullish on U.S. Economy but Less Certain about Personal Finances, Spending Habits and Daily Routines

Do not expect their routines to return to normal until the second half of 2021 leading to changes in consumer behavior

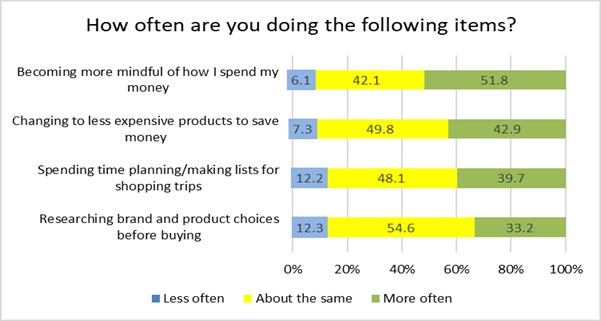

With continued pressure on household income, consumers continue to try new brands with better value being the primary drivers of the new behavior. Forty three percent of Floridians are more often changing to less expensive products to save money and thirty percent of Floridians are more often researching brand and product choices before buying.

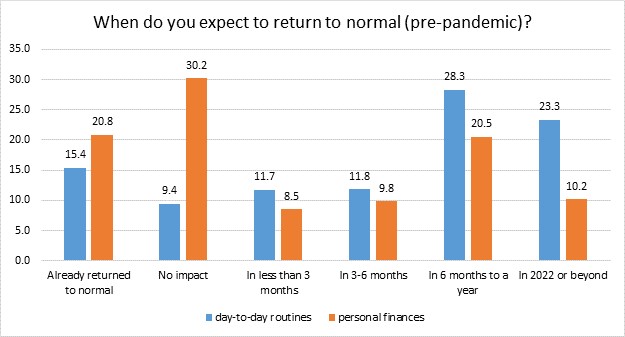

Return to normal (routines vs. finances)

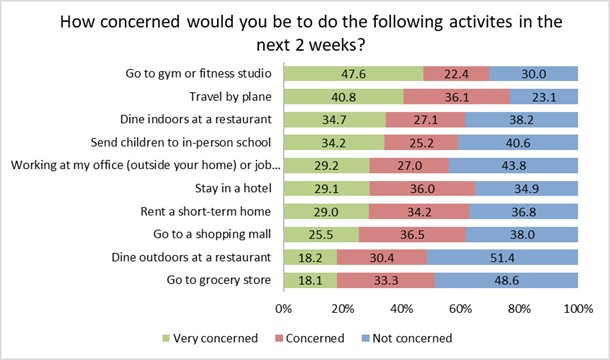

Floridians believe that their “day-to-day routines” will take longer to return to normal than their finances. Around 50 percent of Floridians believe their “day-to-day routines” will not return to normal until the latter half of 2021 or 2022 and beyond. Floridians are still very concerned of indoor activities such as going to the gym (47.6%), traveling by plane (40.8%) and dinning indoors at a restaurant (34.7%).

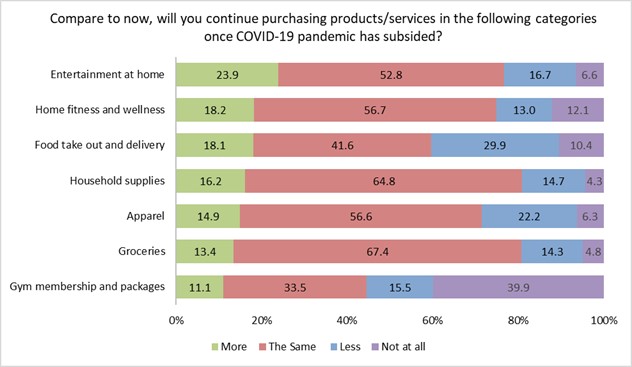

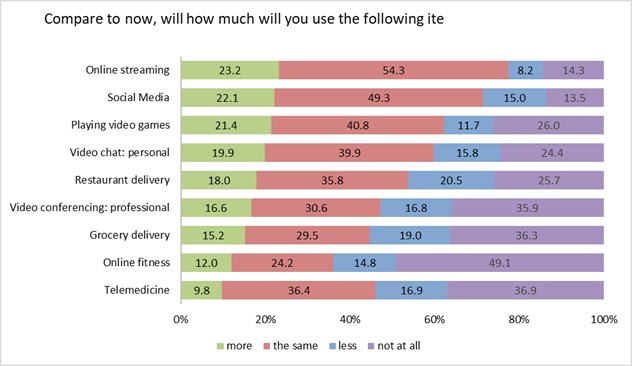

Continuation of homebody economy

There is a continuation of the “homebody” economy among Floridians post-COVID-19. Floridians during the pandemic have adopted many in-home alternatives, and many of these activities such as online streaming, home fitness, and food take-out/delivery are expected to stick post-COVID-19. In addition, Floridians are planning to use more often social media, paying video games and video chatting after the COVID-19 pandemic subsided.

Vaccination

Around 24 percent of Floridians have received the COVID-19 vaccines. In addition, 40 percent of respondents would like the vaccine, 27 percent said they don’t want the vaccine and 9 percent are not sure. Of those individuals that would like the vaccine and those that are not sure, around 18 percent would like the Moderna vaccine, 25 percent would prefer the Pfizer vaccine, 10 percent prefer to wait until another vaccine is available and 47% are not sure.

Methodology

Data was collected February 25-28, 2021 using online survey collected by Dynata and it was administered in English and Spanish. The sample size is n=436, +/- 4.7, Florida residents (18 years old or older). Responses for the entire sample were weighted to reflect the statewide distribution of the Florida population by gender, age, ethnicity, and education.

Graphs of responses regarding consumers views and behavior