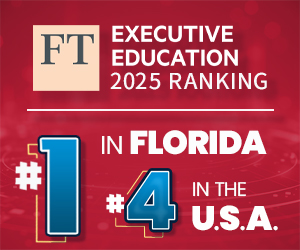

Executive Education Professional Development Programs

No. 1 in Florida and No. 4 in the U.S.

Best MBA in Sport Management

Top-10 in the world according to SportBusiness

AACSB Accreditation

Proud member of AACSB, the premier accreditation agency for business schools

Best Business Programs

Ranked among the best business programs

Best National Universities

Ranked among the best universities

R1 Distinction

Top-tier research university

Best Business Programs

Ranked among the best business programs

Best Graduate Schools in Business

Ranked among the best part-time MBA in business

Top-50 in Undergrad Entrepreneurship

Fifth consecutive ranking from The Princeton Review

Top-50 in Graduate Entrepreneurship

Fifth consecutive ranking from The Princeton Review

Best International Business

No. 23 undergrad. by U.S. News & World Report

Best Online Bachelor's in Business

Ranked among the best online bachelor's in business

ACTA Oases of Excellence

Phil Smith, Adams, and Madden Centers named ACTA Oases of Excellence

Best Part-Time MBA Program

Ranked among the best part-time MBA programs

Best Online Veteran MBA Program

Ranked among the best online veteran MBA programs

Best Online Graduate Program for Veterans in Business

Ranked among the best online graduate programs for veterans in business

Best Online MBA Program in Business

Ranked among the best online MBA programs in business